The landscape of Canada’s Federal Labour Standards is undergoing a significant transformation, bringing about a crucial change that will impact federally regulated employers. Starting from July 9, 2023, these employers will be obligated to reimburse their employees for reasonable work-related expenses. This change marks a significant milestone in ensuring fair treatment and support for workers, acknowledging the financial burdens they may incur in the course of their employment.

In this article, we will explore the specific amendment to the Canada Labour Code (CLC) that mandates the reimbursement of work-related expenses. We will delve into the details of this change and its implications for federally regulated employers, highlighting the importance of embracing this new requirement. Additionally, we will discuss how the implementation of Employee Expense Management Software can streamline and expedite the process of expense submission and reimbursement, ultimately benefiting both employers and employees.

Understanding this pivotal change is essential for employers operating within federally regulated industries. By proactively adapting to the amended Federal Employment Standards and integrating effective reimbursement practices, organizations can demonstrate their commitment to supporting their workforce and fostering a positive work environment.

Throughout the following sections, we will provide a comprehensive overview of the specific requirements for reimbursing work-related expenses and explore the benefits of leveraging Employee Expense Management Software to ensure compliance, streamline processes, and enhance efficiency in managing employee expenses.

The amendments were proclaimed through an Order in Council (OIC) issued by the federal government on April 21, 2023. This OIC serves as the official announcement of the upcoming changes and paves the way for their implementation. The OIC was subsequently published in the Canada Gazette on May 10, 2023, along with accompanying regulations.

As per the published OIC, the new sections and regulations will come into force on July 9, 2023. This effective date marks the point at which federally regulated employers will be required to comply with the amended Federal Labour Standards, including the reimbursement of reasonable work-related expenses.

It is essential for employers to be aware of these changes and prepare accordingly to ensure compliance by the specified effective date. By understanding the scope and implications of the amendments, federally regulated employers can navigate the evolving employment landscape and fulfill their obligations towards their employees. In the subsequent sections, we will delve deeper into the specific requirements related to the reimbursement of work-related expenses and other associated obligations placed on employers.

Section 238.1 of the CLC

All federally regulated employers will now be obligated to reimburse their employees for “reasonable work-related expenses” subject to prescribed exemptions. The scope of this amendment will encompass only those expenses that are accumulated on or after the date the amendments take effect.

This provision emphasizes the employer’s responsibility to alleviate the financial burden incurred by employees while performing their job duties.

Determining Work-Related and Reasonable Expenses

The Canada Labour Standards Regulations provide specific factors to consider when determining whether an expense is work-related and reasonable, as outlined in subsection 23.1(1) and (2) of the Act:

For work-related expenses, the following factors should be taken into account:

- Whether the expense is connected to the employee’s performance of work.

- Whether the expense enables the employee to perform their work effectively.

- Whether incurring the expense is required by the employer as a condition of employment or continued employment.

- Whether the expense satisfies a requirement for the employee’s work imposed by an occupational health or safety standard.

- Whether the expense is incurred for a legitimate business purpose and not for personal use or enjoyment.

Regarding reasonable expenses, the following factors should be considered:

- Whether the expense is connected to the employee’s performance of work.

- Whether the expense is incurred to enable the employee to perform their work effectively.

- Whether the expense is incurred at the request of the employer.

- Whether any amount of the expense goes beyond what is necessary to enable the performance of the work.

- Whether the expense is one that is typically reimbursed by employers in similar industries.

- Whether the employer authorized the expense in advance.

- Whether the expense is incurred by the employee in good faith.

- Whether the claim includes appropriate documentation, such as a receipt or invoice, indicating that the expense was genuinely incurred.

By considering these factors, employers can determine whether an expense is both work-related and reasonable, ensuring compliance with the reimbursement obligations under section 238.1 of the Act.

Timeframe for Reimbursement

Employers are required to process and pay any reimbursable amounts within 30 days from the date an employee submits a claim for eligible expenses. Adhering to this timeframe ensures timely reimbursement and demonstrates the employer’s commitment to supporting their workforce.

Penalties for Breaches

Failure to comply with the reimbursement obligations outlined in section 238.1 can result in penalties for employers. The penalty amounts range from $500 to $6,000, depending on the size of the business. It is crucial for employers to understand and fulfill their reimbursement obligations to avoid potential penalties and maintain compliance with the Federal Labour Standards.

By complying with section 238.1, federally regulated employers demonstrate their commitment to fair treatment and support for their employees. The reimbursement of work-related expenses is not only a legal obligation but also enhances employee satisfaction, fosters a positive work environment, and contributes to increased productivity.

Introduction to the Benefits

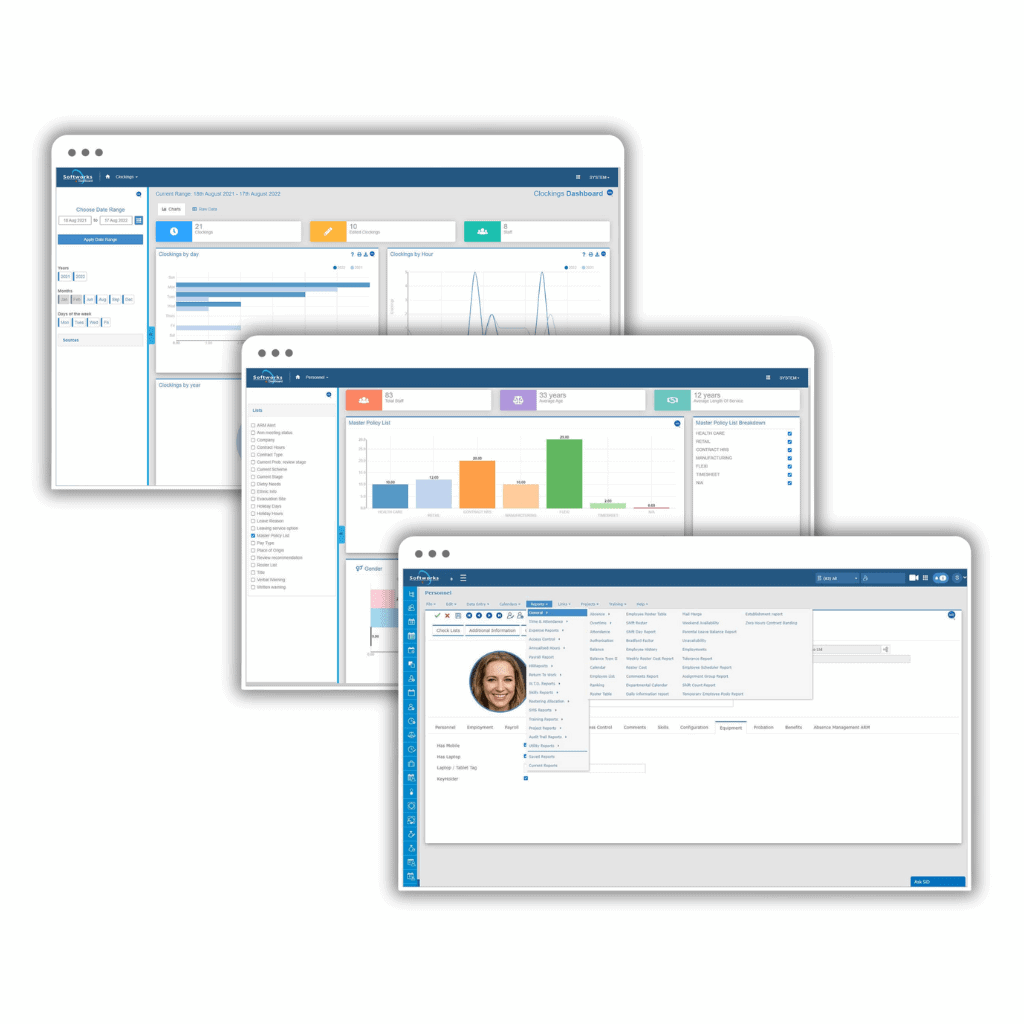

Employee Expense Management Software offers a powerful tool that eliminates the laborious and costly task of manually collecting and processing paper expenses. By implementing this software, organizations can experience a range of benefits, including increased accuracy, enhanced productivity, improved compliance, and greater cost control.

Streamlining Expense Tracking and Submission

The software simplifies the entire process of expense tracking and submission for employees. Instead of dealing with cumbersome paper receipts and manual data entry, employees can effortlessly capture and upload their expenses using digital tools such as mobile apps or web interfaces. This streamlines the entire workflow, saving time and reducing the likelihood of errors or lost receipts.

Automation of Reimbursement and Approval Process

With Employee Expense Management Software, the reimbursement and approval process becomes automated and efficient. The software automatically calculates reimbursable amounts based on predefined rules and policies, eliminating the need for manual calculations. Managers can review and approve expenses digitally, ensuring a swift and streamlined process. The software also allows for seamless integration with payroll systems, ensuring accurate and timely reimbursement to employees.

Time and Cost Savings

Implementing Employee Expense Management Software brings significant time and cost savings for organizations. By eliminating manual tasks associated with expense management, employees can focus on more value-added activities. The automation of processes reduces administrative overhead, minimizes errors, and enhances overall operational efficiency. Additionally, organizations can gain better visibility and control over expenses, enabling them to make informed decisions and optimize cost management.

By leveraging Employee Expense Management Software, organizations can transform their expense management processes, simplify workflows, and ensure compliance with the new reimbursement requirements. The software not only enhances employee experience but also drives cost savings and improves productivity.

Customizable Expense Policies

The software allows organizations to define and enforce customized expense policies based on the new reimbursement requirements. These policies can specify eligible expense categories, spending limits, and approval workflows. By aligning expense policies with the Federal Employment Standards, organizations can ensure compliance and consistency in expense management.

Easy Expense Submission

Employee Expense Management Software provides employees with intuitive interfaces and mobile apps, making it easy for them to submit their work-related expenses. Employees can capture receipts, categorize expenses, and provide necessary details, ensuring accurate and complete expense submissions.

Automated Policy Validation

The software automates policy validation during the expense submission process. It checks expense claims against predefined policies, ensuring compliance with the reimbursement guidelines. Any policy violations or exceptions are flagged, allowing for prompt resolution and reducing the risk of non-compliance.

Efficient Approval Workflows

With the software, organizations can establish streamlined approval workflows for expense reimbursement. Approvers receive notifications, review expense claims, and make timely decisions within the defined policy framework. This ensures consistent and efficient approval processes, reducing delays and bottlenecks.

Real-time Expense Tracking and Reporting

Employee Expense Management Software provides real-time visibility into expense data. Organizations can generate comprehensive reports, track spending patterns, and gain insights into expense trends. These analytics empower organizations to make data-driven decisions, optimize expense management, and identify areas for cost control.

Integration with Payroll Systems

Seamless integration between Employee Expense Management Software and Payroll systems enables automated reimbursement processes. Approved expenses can be seamlessly transferred to payroll, ensuring accurate and timely reimbursement to employees. This integration eliminates manual data entry, reduces errors, and improves efficiency.

By utilizing Employee Expense Management Software, organizations can effectively align their expense management processes with the changes to the Canada Federal Labour Standards. The software provides the necessary tools and functionalities to streamline expense submission, automate policy compliance, and ensure accurate and timely reimbursement.

Conclusion

The upcoming mandate for reimbursing work-related expenses is a significant change to Canada’s Federal Employment Standards. Starting July 9, 2023, federally regulated employers must reimburse employees for reasonable expenses incurred during work. This requirement acknowledges the financial burdens employees face.

To comply with the mandate, employers should embrace the use of Employee Expense Management Software. This software streamlines expense tracking, automates reimbursement processes, and saves time and costs. By adapting to these changes and utilizing technology, employers demonstrate their commitment to supporting their workforce and creating a fair work environment.

To explore how Softworks can assist your organization in effectively managing work-related expenses and ensuring compliance, as a part of our complete Workforce Management Software solution, we invite you to request a free demo. Discover the benefits of our software firsthand and take proactive steps towards efficient and compliant expense management. Contact us today to schedule your demo and empower your organization with streamlined expense tracking and reimbursement processes.

Request a free Demo!

Take the first step towards a complete workforce management solution. Talk to us today!

About Tomislav Rucevic

Tomislav Rucevic, an SEO Specialist at Softworks, stands out as more than just a marketer. He’s a fervent writer and influential thinker passionate about Workforce Management, HR, and work-life dynamics. Holding an MBA in Marketing, Tomislav excels in creating content that delves into the complexities of the modern workplace.

His dedication to writing on these topics is highlighted in his MBA thesis, which examined the link between Employee Motivation and Quality Improvement. At Softworks, he expertly merges his SEO skills with his writing prowess, contributing to the company’s digital success and advancing discussions on enhancing work environments and achieving work-life balance.