The significance of paid sick leave cannot be overstated—it is a crucial aspect of employment that ensures workers don’t have to choose between their health and their paycheck. In a world where unforeseen illnesses can arise at any moment, understanding and advocating for paid sick leave becomes paramount for both employees and employers.

This blog aims to demystify the legal landscape surrounding paid sick leave, providing a clear and concise overview of state-specific laws, as well as insights into the federal Family and Medical Leave Act (FMLA). Whether you’re an employee curious about your rights or an employer looking to comply with the law, this guide is designed to navigate you through the complexities of paid sick leave policies across the nation.

Disclaimer: Please note that the information provided in this blog post is accurate as of the time of writing. Laws and regulations are subject to change over time. While we strive to keep our content as up-to-date as possible, we encourage readers to consult official government resources or legal professionals for the most current information. This blog is intended for informational purposes only and should not be taken as legal advice.

Understanding Paid Sick Leave

What is Paid Sick Leave?

Paid sick leave is a type of employee benefit that allows workers to take time off from work, with pay, due to illness, injury, or the need to care for sick family members. Unlike unpaid leave, paid sick leave ensures that employees do not lose income when they or their loved ones are unwell. This benefit not only supports the physical health of employees but also contributes to their mental and financial well-being.

General Benefits of Paid Sick Leave

For Employees

- Health and Well-being: Employees can rest and recover without the stress of lost income, leading to quicker recovery times and reduced spread of illness in the workplace.

- Financial Security: Paid sick leave provides financial stability, ensuring that an unexpected illness doesn’t lead to economic hardship.

- Enhanced Job Satisfaction: Knowing that paid sick leave is available fosters a sense of security and loyalty among employees, leading to increased job satisfaction and morale.

For Employers

- Increased Productivity: Healthy employees are more productive. By encouraging sick employees to stay home, businesses can reduce the spread of illness, leading to a healthier and more efficient workforce.

- Improved Employee Retention: Offering paid sick leave is an attractive benefit that can help attract and retain top talent. Employees are more likely to stay with a company that values their health and well-being.

- Reduced Workplace Accidents: Well-rested and healthier employees are less likely to be involved in workplace accidents, promoting a safer work environment.

- Positive Brand Image: Companies that provide paid sick leave are often viewed more favorably by the public. This positive brand image can attract customers who prefer to support businesses that take care of their employees.

For the Public Health

- Reduced Spread of Illness: Paid sick leave enables employees to stay home when they are ill without fear of losing income, thereby reducing the spread of infectious diseases in the workplace and the wider community.

- Increased Access to Preventive Care: Employees are more likely to seek preventive care and timely medical treatment, which can reduce the severity of illnesses and prevent outbreaks.

While the implementation of paid sick leave laws may pose challenges for some businesses, particularly small enterprises, the long-term benefits of such policies can outweigh the costs. Healthy employees contribute to a more dynamic and productive workforce, and by reducing the spread of illnesses, businesses and communities can thrive together. Moreover, these laws play a crucial role in ensuring that no employee has to choose between their health and their livelihood, promoting fairness and equity in the workplace.

Learn more: Sick Leave Management with Softworks

Federal Level: Family and Medical Leave Act (FMLA)

When discussing paid sick leave, it’s essential to consider the foundation set by federal laws, particularly the Family and Medical Leave Act (FMLA). The FMLA plays a crucial role in supporting employees during significant life events, offering protections that complement state-specific paid sick leave laws. Although not directly a paid sick leave law, the FMLA ensures that eligible employees of covered employers have the right to take unpaid, job-protected leave for specific family and medical reasons.

This entitlement also includes the continuation of group health insurance coverage under the same terms as if the employee had continued to work.

Key Provisions of the FMLA

Eligible employees under the FMLA are entitled to:

- Twelve work weeks of leave: This can be taken in a 12-month period for several reasons, including but not limited to:

- The birth of a child and to care for the newborn within one year of birth.

- The placement of a child with the employee for adoption or foster care, and to care for the newly placed child within one year of placement.

- Caring for a spouse, child, or parent who has a serious health condition.

- A serious health condition that makes the employee unable to perform the essential functions of their job.

- Any qualifying need arising out of the fact that the employee’s spouse, child, or parent is on covered active duty or call to covered active duty status as a military member.

- Twenty-six work weeks of leave: Available during a single 12-month period to care for a covered servicemember with a serious injury or illness if the eligible employee is the servicemember’s spouse, child, parent, or next of kin, also known as military caregiver leave.

The FMLA’s relevance to paid sick leave lies in its provision of job security during extended periods of absence due to medical and family reasons. It sets a baseline for employee rights to time off for health and family-related issues, around which states can build more comprehensive paid sick leave policies.

While FMLA leave is unpaid, it underscores the importance of allowing employees time away from work for significant health and family reasons without the threat of losing their jobs, thus providing a critical safety net that complements state-level paid sick leave laws.

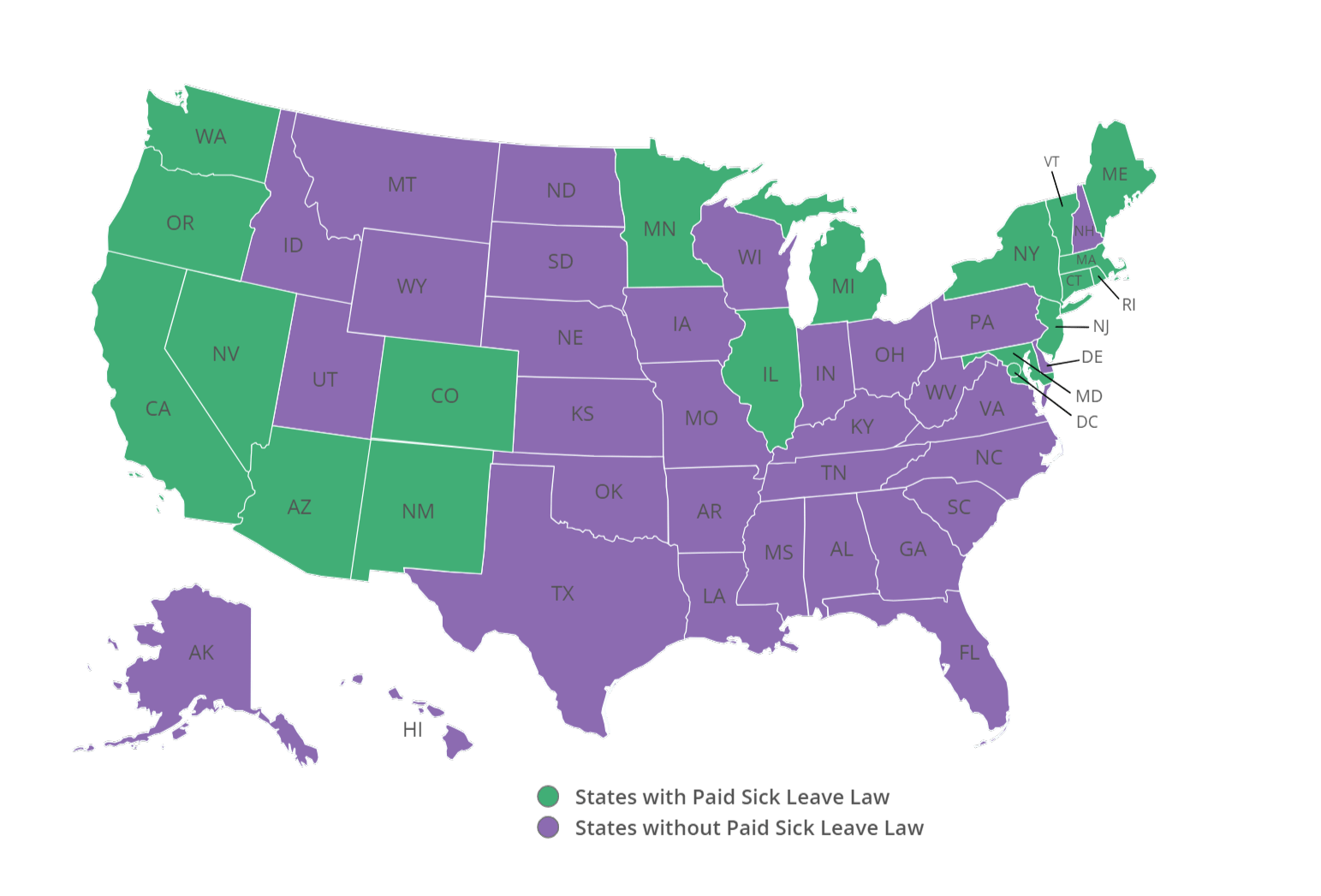

States with Paid Sick Leave Laws

Chart 1. Paid Sick Leave Laws by State (2024)

Arizona

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Employers with 15+ employees = 40 hours

- Employers with less than 15 employees = 24 hours

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

California

- Covered Employers:

- All

- Covered Employees:

- Who worked at least 30 days with the same employer in the current year

- Who worked at least 90 days with the same employer

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- 40 hours or 5 days, whichever

is more

- 40 hours or 5 days, whichever

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Mental health reasons

Colorado

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 48 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

Connecticut

- Covered Employers:

- Employers with 50+ employees

- Covered Employees:

- Employees who work for employers with 50+ employees

- Accruals Rate:

- 1 hour per 40 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Mental health reasons

- Domestic or sexual violence

Illinois

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 40 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- No reason required

Maine

- Covered Employers:

- Employers with 10+ employees

- Covered Employees:

- Employees who worked for 120+ days for the employer with 10+ employees

- Accruals Rate:

- 1 hour per 40 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- No reason required

Maryland

- Covered Employers:

- Employers with 15+ employees

- Covered Employees:

- Employees who work for employers with 15+ employees

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Mental health reasons

- Domestic or sexual violence

- Maternity or paternity leave

Massachusetts

- Covered Employers:

- Employers with 11+ employees

- Covered Employees:

- Employees who work for employers with 11+ employees

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

Michigan

- Covered Employers:

- Employers with 50+ employees

- Covered Employees:

- Employees working 25+ hours weekly, for 26 weeks annually, with their primary job location in Michigan, scheduled for 26+ weeks

- Accruals Rate:

- 1 hour per 35 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

Minnesota

- Covered Employers:

- All

- Covered Employees:

- Employees who work 80+ hours in a year

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 48 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Closure of workplace or closure of a family member’s school or care facility due to weather or public emergency

Nevada

- Covered Employers:

- Employers with 50+ employees

- Covered Employees:

- Employees who work for employers with 50+ employees

- Accruals Rate:

- Full-time workers = 0.01923 hours per hour worked

- Part-time workers = 1 hour per 52 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- No reasons required

New Jersey

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Preventive care

- Meeting regarding a child’s health or disability

- School conference

New Mexico

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 64 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Preventive care

- Meeting regarding a child’s health or disability

- School conference

New York

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Employers with 0 – 4 employees with income equal to or less than $ 1 million = Up to 40 hours unpaid

- Employers with 0 – 4 employees with income over $ 1 million = Up to 40 hours paid

- Employers with 5 – 99 employees = up to 40 hours paid

- Employers with 100+ employees = up to 56 hours paid

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Preventive care

Oregon

- Covered Employers:

- Employers with 10+ employees

- 6+ if they have a location in Portland

- Covered Employees:

- All employees of employers with 10+ employees (6+ if they have a location in Portland)

- Accruals Rate:

- 1 hour per 30 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Death in the family

- Closure of workplace or closure of a family member’s school or care facility due to weather or public emergency

Rhode Island

- Covered Employers:

- Employers with 18+ employees

- Covered Employees:

- Employees with primary residency in Rhode Island who work for employers with 18+ employees

- Accruals Rate:

- 1 hour per 35 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Closure of workplace or closure of a family member’s school or care facility due to weather or public emergency

Vermont

- Covered Employers:

- All

- Covered Employees:

- Employees who work for an average of 18+ hours per week during a year

- Accruals Rate:

- 1 hour per 52 worked

- Max Usage per Year:

- Up to 40 hours per year

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Closure of workplace or closure of a family member’s school or care facility due to weather or public emergency

Washington

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- 1 hour per 40 worked

- Max Usage per Year:

- No annual accruals

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Mental health reasons

Washington D.C.

- Covered Employers:

- All

- Covered Employees:

- All

- Accruals Rate:

- Employers with up to 24 employees = 1 hour per 87 worked

- Employers with 25 – 99 employees = 1 hour per 43 worked

- Employers with 100+ employees = 1 hour per 37 worked

- Max Usage per Year:

- Employers with up to 24 employees = Up to 3 days

- Employers with 25 – 99 employees = Up to 5 days

- Employers with 100+ employees = Up to 7 days

- Qualifying Reasons:

- Personal illness

- Family illness

- Doctor visits

- Domestic or sexual violence

- Mental health reasons

States with No Mandatory Paid Sick Leave Laws

In the patchwork of paid sick leave laws across the United States, a significant number of states do not have mandatory paid sick leave laws in place. This means that in these states, employers are not required by state law to provide paid sick leave to their employees. However, employers may still choose to offer paid sick leave as part of their benefits package.

The states without comprehensive mandatory paid sick leave laws include:

Alabama, Georgia, Montana, Alaska, Hawaii, Nebraska, Arkansas, Idaho, New Hampshire, Delaware, Indiana, North Carolina, Florida, Iowa, North Dakota, Kentucky, Louisiana, Ohio, Mississippi, Missouri, Oklahoma, Kansas, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, West Virginia, Wisconsin, and Wyoming.

The absence of state-mandated paid sick leave in these states highlights the variability of employee benefits across the country and underscores the importance of federal protections like the Family and Medical Leave Act (FMLA).

It also emphasizes the role of local governments and private employers in filling the gap left by the absence of state legislation. Workers and employers in these states are encouraged to check local regulations and employment policies for specific sick leave provisions, as they may offer benefits beyond what is mandated at the state level.

Challenges and Considerations

The implementation of paid sick leave laws, while beneficial in many respects, does come with its set of challenges for employers. Additionally, in states lacking comprehensive laws, there are significant considerations regarding the impact on workers.

Challenges for Employers

- Financial Strain: Small businesses, in particular, may find the financial implications of providing paid sick leave challenging. The cost of covering wages for absent employees, along with the potential hiring of temporary replacements, can be significant.

- Administrative Burden: The implementation of paid sick leave policies demands advanced systems for tracking leave entitlements and compliance with diverse laws, a task complicated for businesses in multiple states. Absence Management Software, like Softworks, can ease this burden by automating leave tracking and ensuring regulatory compliance, simplifying the management of paid sick leave, and allowing businesses to focus on their core operations.

- Workforce Management: Employers face the challenge of providing sick leave while maintaining operational efficiency, a task that becomes particularly complex during peak periods or when multiple employees are absent simultaneously. Softworks Workforce Management Software offers a solution by streamlining scheduling, tracking absences in real-time, and predicting staffing needs, ensuring that businesses can efficiently manage their workforce even in the face of unexpected sick leave requests.

- Compliance Complexity: Navigating the federal, state, and local regulations can be daunting. Compliance requires staying up-to-date with changing laws and understanding how they apply to different aspects of business operations.

Considerations for States Without Comprehensive Laws

- Worker Vulnerability: In states without mandated paid sick leave, workers may face the difficult choice between going to work ill (potentially worsening their condition and spreading illness) and losing income or even their jobs.

- Public Health Risks: The absence of paid sick leave policies can contribute to public health risks, especially in sectors where employees interact closely with the public, such as food service and retail.

- Economic Disparities: Workers in lower-income jobs are less likely to have access to paid sick leave, exacerbating economic and health disparities. This can have long-term impacts on the well-being of families and communities.

- Policy Gaps: The lack of uniformity in sick leave policies means that workers’ access to paid sick leave can depend heavily on their employer’s policies or the city or county in which they work, leading to inequities and confusion.

The challenges and considerations surrounding the implementation of paid sick leave laws underscore the need for careful planning and support for both employers and employees. For employers, this may involve seeking resources and guidance to comply with laws effectively and sustainably. For states without comprehensive laws, raising awareness about the benefits of paid sick leave and advocating for broader legislation can help protect workers and the public alike.

In addressing these challenges, it’s crucial to strike a balance that supports the health and well-being of employees while ensuring businesses can operate effectively and efficiently. The dialogue between employers, employees, and policymakers plays a key role in evolving and refining paid sick leave policies to meet the needs of all stakeholders.

Future of Paid Sick Leave in the U.S.

While the U.S. lags behind many developed nations in offering mandatory paid sick leave, the landscape is shifting. Understanding the potential trends and staying informed about legislative updates is crucial for both workers and businesses.

Emerging Trends

- Momentum at the state level: Though only 18 states and D.C. currently have mandatory paid sick leave laws, numerous others are considering similar legislation. Public support for such measures remains high, suggesting more states could join the fold.

- Federal push: The Healthy Families Act, introduced in 2023, proposes to guarantee up to seven paid sick days nationally. While its passage faces political hurdles, it signifies rising federal interest in addressing the issue.

- Industry-specific regulations: Certain industries, like service and hospitality, may see targeted paid sick leave regulations due to their higher risks of illness transmission and lower average wages.

- Evolving employer models: Forward-thinking businesses may introduce more flexible paid leave policies, including accrual options and expanded qualifying reasons, to boost employee satisfaction and attract talent.

Potential Changes

- Expansion of state-level laws: Expect more states to enact paid sick leave requirements, with variations in specifics like accrual rates and covered employers.

- Federal legislation: While the Healthy Families Act faces challenges, similar proposals or scaled-down versions may gain traction in the future.

- Hybrid approaches: Combining federal minimum standards with state-specific flexibility could be a future compromise.

- Increased litigation: Businesses operating across multiple states with varying laws may face legal challenges regarding leave compliance.

The future of paid sick leave remains uncertain, but it’s clear that momentum is building for change. By staying informed, both workers and businesses can prepare for potential shifts and advocate for solutions that prioritize both employee well-being and economic efficiency.

Conclusion

The landscape of paid sick leave laws in the United States is diverse, with significant variations from state to state. Understanding and adhering to these laws is not just a legal obligation for employers but a critical component of fostering a healthy, productive, and satisfied workforce. Paid sick leave not only supports public health by reducing the spread of illness but also enhances employee well-being and contributes to the overall operational efficiency of businesses.

As we navigate these complex regulations, it’s essential for both employers and employees to stay informed and proactive in their approach to paid sick leave. Tools and solutions like Softworks Workforce Management Software can greatly assist in managing these challenges, ensuring compliance, and maintaining business continuity.

We encourage you to engage in discussions about the importance of paid sick leave and share this blog post to spread awareness. By doing so, we can collectively advocate for policies that support workers’ health and well-being, while also considering the operational needs of businesses.

Request a free Demo!

Take the first step towards a complete workforce management solution. Talk to us today!

Sources

- Family and Medical Leave Act, U.S. Department of Labor (.gov)

- 23-372. Accrual of earned paid sick time, Arizona State Legislature (.gov)

- Paid Sick Leave in California, California Department of Industrial Relations (.gov)

- Paid Sick Leave under the Colorado Healthy Families and Workplaces Act (HFWA), Colorado Department of Labor and Employment (.gov)

- Connecticut General Statute 31-57r – Paid Sick Leave, Connecticut Department of Labor (.gov)

- Paid Leave for All Workers Act, Illinois Department of Labor (.gov)

- Earned Paid Leave law, Maine Legislature (.gov)

- Maryland Sample Earned Sick and Safe Leave Policies, Maryland Department of Labor (.gov)

- Massachusetts law about sick leave, Mass.gov

- Paid Medical Leave Act, Michigan Legislature (.gov)

- Earned Sick and Safe Time (ESST), Minnesota Department of Labor and Industry (.gov)

- Chapter 608 – Compensation, Wages And Hours, Nevada Legislature

- NJ State Wage and Hour Laws and Regulations, New Jersey Department of Labor and Workforce Development (.gov)

- 2021 New Mexico Statutes Chapter 50 – Employment Law Article 17 – Healthy Workplaces Section 50-17-3 – Earned sick leave; use and accrual. (Effective July 1, 2022.), Justia US Law

- New York Paid Sick Leave, New Your State (.gov)

- Chapter 839 Division 7 Oregon Sict Time, Oregon Secretary of State

- Healthy and Safe Families and Workplaces Act, Rhode Island Department of Labor and Training (.gov)

- Vermont Earned Sick Time Law Frequently Asked Questions, Vermont Department of Labor (.gov)

- Paid Sick Leave Minimum Requirements, Washington State Department of Labor & Industries (.gov)

- Code of the District of Columbia Subchapter III. Employee Sick Leave, Council of District of Columbia (.gov)

- S.1664 – Healthy Families Act, 118th Congress (2023-2024) (.gov)

About Tomislav Rucevic

Tomislav Rucevic, an SEO Specialist at Softworks, stands out as more than just a marketer. He’s a fervent writer and influential thinker passionate about Workforce Management, HR, and work-life dynamics. Holding an MBA in Marketing, Tomislav excels in creating content that delves into the complexities of the modern workplace.

His dedication to writing on these topics is highlighted in his MBA thesis, which examined the link between Employee Motivation and Quality Improvement. At Softworks, he expertly merges his SEO skills with his writing prowess, contributing to the company’s digital success and advancing discussions on enhancing work environments and achieving work-life balance.