The Fair Labor Standards Act (FLSA) plays a pivotal role in shaping employment standards in the United States. By regulating critical areas like minimum wage, overtime pay, child labor, and recordkeeping, the FLSA aims to establish fairness and equality within the workforce. Compliance with this act is not only crucial for employers but also essential for safeguarding the rights of employees.

In this blog post, we will delve into the core provisions of the FLSA, unraveling its intricacies, and offering practical guidance to ensure compliance. Whether you’re an employer striving to uphold labor standards or an employee seeking to understand your rights, this comprehensive guide will equip you with the necessary knowledge to navigate the complexities of the FLSA successfully.

Let’s dive in and explore the key aspects of complying with the Fair Labor Standards Act in the USA.

Understanding the Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) stands as a pillar of protection for workers’ rights in the United States. It sets forth guidelines and regulations that employers must follow to ensure fair treatment and compensation for their employees. By familiarizing ourselves with the history and purpose of the FLSA, we can better appreciate its role in safeguarding workers’ well-being and promoting a more equitable and just work environment.

Overview of FLSA

The Fair Labor Standards Act (FLSA) was enacted in 1938 and remains a cornerstone of labor law in the United States. It was established to establish fair working conditions, protect employees’ rights, and ensure equitable compensation. The FLSA sets standards for minimum wage, overtime pay, child labor regulations, and recordkeeping requirements. By providing these guidelines, the FLSA aims to promote a level playing field for workers and prevent exploitation.

The FLSA is administered by the Wage and Hour Division (WHD) of the U.S. Department of Labor (DOL). It has undergone amendments and updates over the years to address changing labor market dynamics and protect the evolving needs of employees.

Coverage and Exemptions

The FLSA applies to most employers and employees engaged in interstate commerce or involved in the production of goods for interstate commerce. It also covers certain specific enterprises, such as hospitals, schools, and government agencies.

However, it’s essential to note that not all employees and employers fall under the FLSA’s jurisdiction. Certain exemptions exist based on job duties, salary thresholds, and industry-specific regulations.

Some common exemptions include:

- Executive, administrative, and professional employees (commonly known as the white-collar exemptions): These individuals must meet specific criteria related to their job duties, salary basis, and level of authority.

- Outside sales employees: Employees whose primary duties involve making sales or obtaining orders away from their employer’s place of business may be exempt.

- Certain industries or job positions: The FLSA provides exemptions for certain industries, such as agriculture, seasonal amusement or recreational establishments, and certain commissioned sales employees.

It’s important for employers and employees to understand the coverage and exemptions applicable to their specific circumstances to ensure compliance with the FLSA – View all exemptions

Minimum Wage Requirements

The Fair Labor Standards Act (FLSA) stands as a pillar of protection for workers’ rights in the United States. It sets forth guidelines and regulations that employers must follow to ensure fair treatment and compensation for their employees. By familiarizing ourselves with the history and purpose of the FLSA, we can better appreciate its role in safeguarding workers’ well-being and promoting a more equitable and just work environment.

Current Minimum Wage

The federal minimum wage in the United States remains at $7.25 per hour in 2023. While this rate sets a baseline for minimum wage requirements across the country, it’s essential to note that individual states may have their own minimum wage rates, which can be higher than the federal rate.

To find the specific minimum wage rates for each state, you can refer to this table: Consolidated Minimum Wage Table – U.S. Department of Labor

Exceptions and Special Circumstances

While the minimum wage applies to most employees, there are certain exceptions and special circumstances that warrant attention. Some common exceptions include:

- Tipped employees – The FLSA allows for a lower minimum cash wage for tipped employees, where employers can take a tip credit towards their minimum wage obligations. The tip credit is the difference between the cash wage paid by the employer and the minimum wage rate. However, employers must ensure that the combined amount of tips received and the cash wage paid equals or exceeds the minimum wage rate.

To find the specific minimum wage rates for tipped employees per each state, you can refer to this table: Minimum Wages for Tipped Employees – U.S. Department of Labor

- Workers with disabilities – The FLSA provides provisions for employees with disabilities that may enable employers to pay subminimum wages under specific circumstances. These provisions aim to promote employment opportunities for individuals with disabilities while ensuring that they receive a fair wage based on their productivity.

It’s important for employers to fully understand the exceptions and special circumstances related to minimum wage requirements to ensure compliance and fair treatment of employees.

Compliance Tips

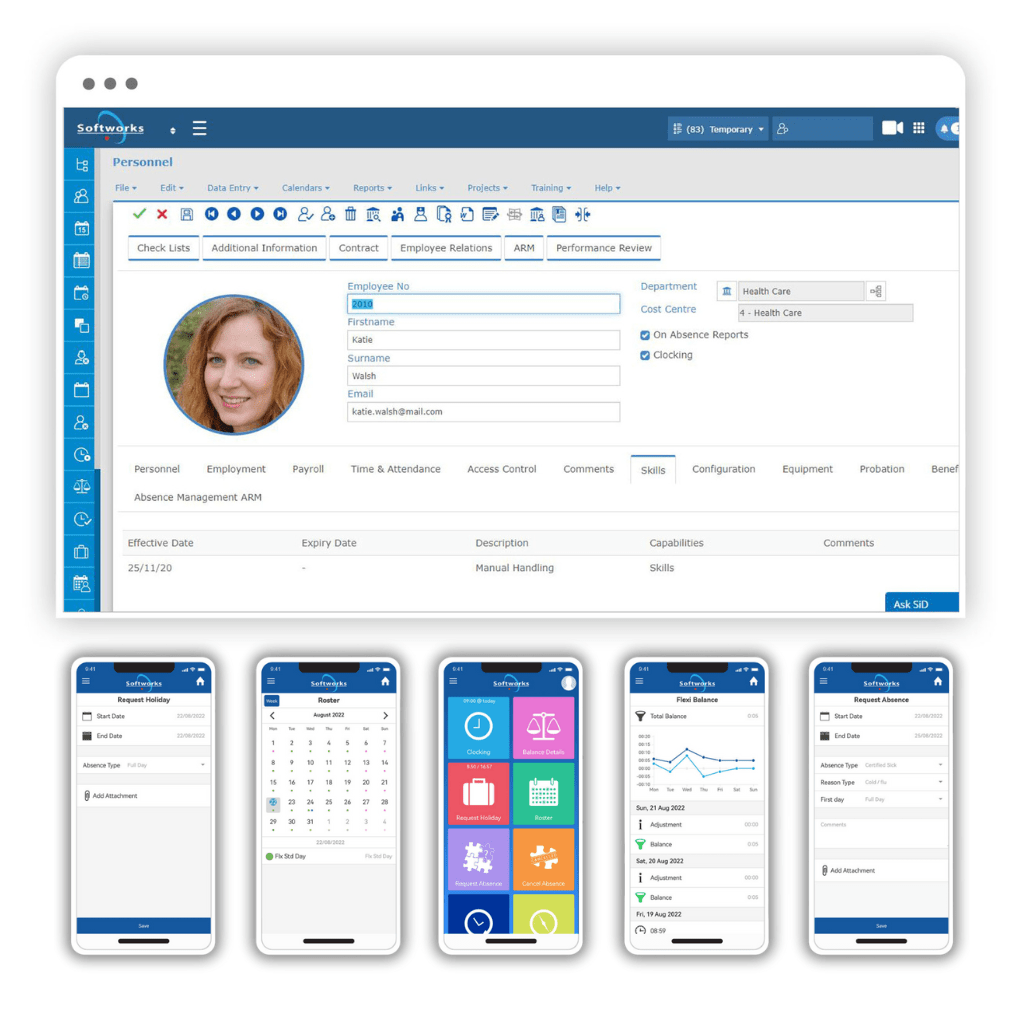

Achieving compliance with minimum wage laws requires diligent recordkeeping and transparent pay policies. To streamline these processes and enhance compliance efforts, employers can leverage advanced workforce management software. Here are some practical suggestions for employers to ensure compliance with minimum wage laws, including incorporating the use of workforce management software:

1. Maintain accurate records

Keep detailed records of hours worked by each employee, including regular hours and any overtime hours. Workforce management software with Time & Attendance capabilities can automate timekeeping processes, making it easier to track and document hours worked accurately.

2. Implement transparent pay policies

Clearly communicate the pay structure to employees, including the minimum wage rate, any tip credit policies for tipped employees, and any applicable deductions or allowances. Workforce management software can assist in generating transparent pay statements that provide a breakdown of wages and deductions, ensuring compliance and fostering transparency.

3. Stay informed about changes

Regularly check for updates from the Wage and Hour Division or relevant state labor departments regarding any changes in the federal or state minimum wage rates.

By incorporating the use of workforce management software, employers can streamline recordkeeping, automate compliance processes, and ensure accurate calculation of wages, all while maintaining compliance with minimum wage laws.

With these compliance tips employers can uphold fair compensation practices and foster a positive work environment.

Overtime Pay

Definition and Eligibility

Overtime work refers to the hours worked by an employee beyond the standard workweek or daily working hours established by the Fair Labor Standards Act (FLSA). To determine employee eligibility for overtime pay, the FLSA follows a general rule: employees covered by the FLSA must receive overtime pay at a rate of one and a half times their regular rate of pay for any hours worked beyond 40 hours in a workweek. However, it’s important to note that state laws may have additional or different criteria for overtime eligibility.

Calculating Overtime Pay

Calculating overtime pay involves determining the regular rate of pay and applying the time-and-a-half pay requirement.

Here’s how it works:

- Regular Rate Calculation – To calculate the regular rate, divide the employee’s total compensation in a workweek (including salary, hourly wages, and nondiscretionary bonuses) by the total hours worked in that week. The regular rate may vary if the employee receives different types of compensation.

- Time-and-a-Half Pay – Once the regular rate is determined, any hours worked beyond 40 in a workweek must be compensated at one and a half times the regular rate. For example, if the regular rate is $15 per hour, the overtime rate would be $22.50 per hour.

Exemptions

The FLSA provides exemptions from overtime pay requirements for certain job positions or industries.

Some common exemptions include:

- Executive, administrative, and professional employees (white-collar exemptions) – Employees in these categories must meet specific criteria related to their job duties, salary basis, and level of authority to qualify for exemption from overtime pay.

- Computer professionals – Certain computer professionals who meet specific criteria may be exempt from overtime pay.

- Outside sales employees – Employees whose primary duties involve making sales or obtaining orders away from their employer’s place of business may be exempt from overtime pay.

It’s important for employers to familiarize themselves with these exemptions and ensure proper classification of employees.

Compliance Tips

To ensure compliance with overtime pay regulations, employers should consider the following tips, including the integration of workforce management software:

1. Maintain proper timekeeping records

Accurate recordkeeping is crucial to track hours worked, including regular and overtime hours. Workforce management software with Time & Attendance capabilities can automate time tracking, making it easier to record and monitor employee work hours while ensuring accurate calculations.

2. Establish fair scheduling practices

Develop scheduling policies that prioritize equitable distribution of work hours and minimize the need for excessive overtime. Workforce management software with Employee Scheduling included can help optimize scheduling by considering factors such as employee availability, fairness, skill sets, and labor laws to create efficient and compliant schedules.

3. Implement clear overtime policies

Clearly communicate overtime policies to employees, including how overtime is calculated, when it applies, and how it will be compensated. Workforce management software can assist in generating automated notifications to employees when they approach or exceed overtime thresholds, promoting transparency and compliance.

4. Leverage workforce management software

Integrate workforce management software to streamline timekeeping, automate overtime calculations, and ensure accurate payroll processing. By leveraging advanced features of the software, employers can accurately track hours, identify overtime hours, and generate detailed reports for compliance purposes.

By following these compliance tips, employers can maintain proper timekeeping records, implement fair scheduling practices, and uphold the overtime pay requirements outlined by the FLSA.

Child Labor Provisions

The Fair Labor Standards Act (FLSA) includes specific provisions regarding child labor to protect the educational opportunities and well-being of minors. These provisions prohibit their employment in jobs and under conditions that may be detrimental to their health or development. Here’s an overview of the child labor regulations:

Nonagricultural Jobs (Child Labor)

Regulations governing child labor in non-farm jobs differ somewhat from those pertaining to agricultural employment. In non-farm work, the permissible jobs and hours of work, by age, are as follows:

- Youths 18 years or older – They may perform any job, whether hazardous or not, for unlimited hours.

- Minors 16 and 17 years old – They may perform any nonhazardous job, for unlimited hours.

- Minors 14 and 15 years old – They may work outside school hours in various nonmanufacturing, nonmining, nonhazardous jobs. The conditions include no more than 3 hours on a school day, 18 hours in a school week, 8 hours on a non-school day, or 40 hours in a non-school week.

Additionally, work should not begin before 7 a.m. or end after 7 p.m., except between June 1 and Labor Day when evening hours extend until 9 p.m. There are also special provisions for youths enrolled in approved Work Experience and Career Exploration Programs (WECEP) and academically oriented youths in approved Work-Study Programs (WSP).

Fourteen is the minimum age for most non-farm work. However, at any age, minors may deliver newspapers, perform in radio, television, movie, or theatrical productions, work for parents in their solely-owned non-farm business (except in mining, manufacturing, or hazardous jobs), or gather evergreens and make evergreen wreaths.

Farm Jobs (Child Labor)

In farm work, permissible jobs and hours of work, by age, are as follows:

- Minors 16 years and older – They may perform any job, whether hazardous or not, for unlimited hours.

- Minors 14 and 15 years old – They may perform any nonhazardous farm job outside of school hours.

- Minors 12 and 13 years old – They may work outside of school hours in nonhazardous jobs, either with written consent from a parent or on the same farm as their parent(s).

- Minors under 12 years old – They may perform jobs on farms owned or operated by their parent(s), or with a parent’s written consent, outside of school hours in nonhazardous jobs on farms not covered by minimum wage requirements.

- Minors of any age – They may be employed by their parents in any occupation on a farm owned or operated by their parents.

Compliance Tips

Ensuring compliance with child labor regulations is essential to protect the well-being of young employees. Here are some practical tips for employers:

1. Obtain proper work permits

Depending on the state, minors may be required to obtain work permits or age certificates to ensure they meet the age and educational requirements for employment. Familiarize yourself with the specific regulations in your state and obtain the necessary permits.

2. Maintain accurate age records

Keep accurate records of the ages of your minor employees. This will help demonstrate compliance in case of inspections or audits.

3. Provide a safe work environment

Ensure that the working conditions for minors comply with safety regulations and are free from hazards that could potentially harm their health or well-being.

4. Train supervisors and managers

Educate your supervisors and managers about child labor regulations to ensure they are aware of the restrictions and requirements when employing minors. Provide guidelines on appropriate tasks, work hours, and safety protocols.

5. Regularly review and update policies

Stay updated with any changes in child labor laws and regulations. Review and update your policies and procedures accordingly to ensure ongoing compliance.

By following these compliance tips, employers can create a safe and lawful work environment for young employees while adhering to child labor regulations.

Recordkeeping Requirements

- Demonstrating compliance – Accurate records provide evidence of the employer’s adherence to FLSA regulations, such as minimum wage and overtime pay requirements. These records can serve as essential documentation in case of audits, investigations, or employee disputes.

- Wage calculation and payment – Employment records help calculate wages accurately, including regular pay, overtime pay, deductions, and bonuses. They facilitate precise payroll processing and ensure employees receive appropriate compensation.

- Monitoring hours worked – Detailed records enable employers to monitor and track employees’ hours worked, including regular hours, breaks, and overtime hours. This information is crucial for complying with maximum hour limitations and determining eligibility for overtime pay.

- Compliance with other labor laws – Accurate employment records can also assist employers in complying with other labor laws, such as those related to meal and rest breaks, family and medical leave, and anti-discrimination regulations.

Required Information

Employers must maintain certain essential records to comply with the FLSA. The key information to be included in employment records may include:

- Employee information – Name, address, date of birth (for minors), and social security number or employee identification number.

- Hours worked – Records showing the actual hours worked by each employee, including regular hours, overtime hours, and break times.

- Wages paid – Documentation of wages paid to each employee, including rates of pay, overtime rates, bonuses, and any deductions or adjustments.

- Timekeeping records – Timecards, timesheets, or electronic records that track the hours worked by each employee.

- Payroll records – Payroll registers, payroll summaries, or any other documentation that summarizes wages, hours, and payments made to employees.

- Records of employment agreements or contracts – Copies of any employment agreements, contracts, or collective bargaining agreements that specify terms of employment.

- Deductions and allowances – Documentation of any deductions or allowances made from employee wages, such as taxes, benefits contributions, or garnishments.

View the full list of basic records required: Recordkeeping Requirements under the Fair Labor Standards Act (FLSA) – U.S. Department of Labor

Compliance Tips

Employers can follow these best practices for recordkeeping to ensure compliance with the FLSA:

1. Utilize electronic recordkeeping systems

Electronic systems can streamline recordkeeping processes, reduce errors, and enhance accessibility. Choose reliable software or platforms specifically designed for workforce management and recordkeeping.

2. Retain records for the required period

Maintain employment records for at least three years. However, certain records, such as payroll records, collective bargaining agreements, and employee notices, may need to be retained for a longer period. Consult the specific retention requirements outlined by federal and state regulations.

3. Ensure accessibility and confidentiality

Records should be accessible to employees and authorized government agencies upon request. At the same time, employers must protect the confidentiality of sensitive employee information and maintain data security measures.

4. Regularly review and update records

Periodically review employment records to ensure accuracy, completeness, and compliance with changing laws and regulations. Update records promptly when changes occur, such as wage adjustments, promotions, or terminations.

By following these compliance tips and implementing effective recordkeeping practices, employers can demonstrate adherence to the FLSA and maintain accurate employment records.

Conclusion

Complying with the Fair Labor Standards Act (FLSA) is essential for employers to ensure fair treatment and protection of workers’ rights in the United States. This comprehensive guide has provided valuable insights into key aspects of FLSA compliance, including minimum wage requirements, overtime pay, child labor provisions, and recordkeeping requirements.

By understanding the coverage and exemptions of the FLSA, employers can navigate the regulations effectively and ensure appropriate compensation for their employees. Compliance tips, such as implementing transparent pay policies and utilizing workforce management software, can streamline processes and enhance accuracy in meeting FLSA obligations.

Additionally, the guide emphasized the significance of maintaining accurate employment records. Proper recordkeeping not only aids in demonstrating compliance but also enables accurate wage calculations and adherence to other labor laws. By adopting electronic recordkeeping systems and following best practices, employers can ensure accessibility, confidentiality, and regulatory compliance.

As labor laws continue to evolve, it is crucial for employers to stay informed and regularly review their policies and practices to remain in compliance with the FLSA. By prioritizing fair treatment, equitable compensation, and a safe work environment, employers can foster positive workplace cultures that benefit both their employees and their organizations as a whole.

With this comprehensive guide, employers and employees alike can confidently navigate the complexities of the FLSA, promoting fair labor practices and upholding the principles of worker protection and equality in the United States.

Request a free Demo!

Take the first step towards a complete workforce management solution. Talk to us today!

SOURCES

- Wages and the Fair Labor Standards Act – U.S. Department of Labor

- Handy Reference Guide to the Fair Labor Standards Act – U.S. Department of Labor

- Minimum Wage – U.S. Department of Labor

- State Minimum Wage Laws – U.S. Department of Labor

- Minimum Wages for Tipped Employees – U.S. Department of Labor

- Young Workers – U.S. Department of Labor

- Recordkeeping Requirements under the Fair Labor Standards Act (FLSA) – U.S. Department of Labor

About Tomislav Rucevic

Tomislav Rucevic, an SEO Specialist at Softworks, stands out as more than just a marketer. He’s a fervent writer and influential thinker passionate about Workforce Management, HR, and work-life dynamics. Holding an MBA in Marketing, Tomislav excels in creating content that delves into the complexities of the modern workplace.

His dedication to writing on these topics is highlighted in his MBA thesis, which examined the link between Employee Motivation and Quality Improvement. At Softworks, he expertly merges his SEO skills with his writing prowess, contributing to the company’s digital success and advancing discussions on enhancing work environments and achieving work-life balance.